What Is a Good Deductible for Health Insurance? A Simple Guide

Hello there! Navigating the world of health insurance can feel like trying to solve a complicated puzzle, especially when terms like “deductible” pop up. You’ve found a health plan with a low monthly premium, which sounds great, but then you see a number called the ‘deductible’ and it’s $7,000. Is that good or bad?

It’s completely normal to feel confused! But don’t worry, you’re in the right place. This guide is here to simplify everything. We’re going to break down what a good deductible for health insurance really means, and how you can confidently choose the plan that best fits your life and your budget.

Let’s dive in!

What is a Health Insurance Deductible, Explained Simply?

Let’s use a simple analogy to make this crystal clear.

Think of your health insurance deductible like the “entry fee” you have to pay at the hospital or doctor’s office before your insurance “opens the door” and starts paying for your care.

Here’s how it works in practice:

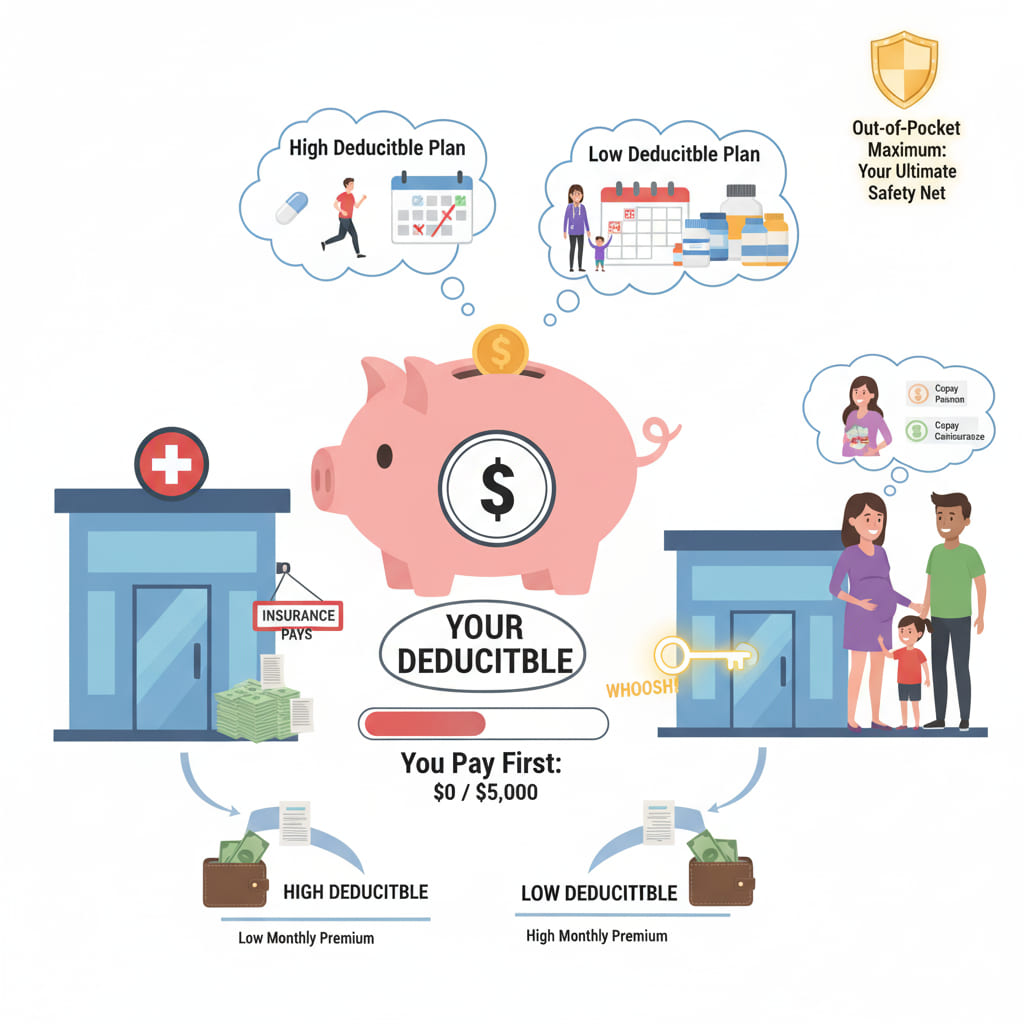

* You Pay First: When you go to the doctor or have a medical procedure, you are responsible for paying the bills up to your deductible amount. This money comes directly out of your pocket.

* Then Insurance Kicks In: Once you have paid that full deductible amount, your insurance company then starts to pay for a portion of your covered medical expenses.

* It Resets: Most health insurance deductibles reset at the beginning of each plan year (usually January 1st). So, if you meet your deductible in November, you’ll start all over again paying your deductible in January.

Important Note: Many plans cover certain services, like preventive care (your annual physical, some screenings), before you meet your deductible. This is a huge benefit, so always check what your plan covers from day one!

The Golden Rule: High Deductible vs. Low Deductible

When you’re comparing health insurance plans, you’ll notice a fundamental trade-off. It’s the “Golden Rule” of deductibles:

1. Low Deductible Health Plan

* Higher Monthly Premium: You pay more each month for your insurance, even if you don’t use it.

* Lower Out-of-Pocket Costs (When You Need Care): If you get sick or have an accident, you’ll pay less out of your own pocket before your insurance starts contributing significantly.

* Predictable Expenses: These plans are often preferred by people who anticipate needing more medical care throughout the year.

2. High Deductible Health Plan (HDHP)

* Lower Monthly Premium: You pay less each month for your insurance, which can be appealing for budget reasons.

* Higher Out-of-Pocket Costs (When You Need Care): If you get sick or have an accident, you’ll have to pay a larger amount out of your own pocket before your insurance coverage fully kicks in.

* Health Savings Account (HSA) Eligibility: A major benefit of HDHPs is that they often make you eligible to open and contribute to a Health Savings Account (HSA). An HSA is a special savings account where you can save money for medical expenses tax-free. It’s like a personal piggy bank just for healthcare, and it offers amazing tax benefits!

So, What is a Good Deductible for You?

This is the million-dollar question, and the honest answer is: there is no single “good” deductible for everyone. What’s good for your neighbor might be terrible for you, and vice-versa.

The “best” deductible is the one that fits your unique situation. To figure this out, you need to think about two main things:

1. Your Health Needs

* Are you generally young and healthy? Do you rarely go to the doctor beyond your annual check-up?

* Many healthy individuals might find a high deductible plan appealing. Their low monthly premiums mean they save money year-round, and they might never even hit their deductible.

* Do you have a chronic condition? Do you see specialists regularly, take expensive prescription medications, or expect frequent doctor visits?

* A low deductible plan might be a better fit. Even with a higher monthly premium, your overall yearly costs could be lower because your insurance starts paying sooner for your ongoing care.

* Are you planning to start a family or already have young children?

* Many families prefer lower deductibles. Children, especially young ones, can have unexpected illnesses or accidents that lead to frequent doctor visits. A lower deductible means less out-of-pocket stress during those times.

2. Your Financial Situation

* Do you have an emergency fund? Could you comfortably cover a high deductible ($3,000, $5,000, or even $7,000+) if something unexpected happened, like a broken bone or a sudden illness?

* If yes, a high deductible plan could be a smart financial move. You save on monthly premiums, and if a major event occurs, you have the savings to cover your initial costs.

* Do you prefer predictable costs? Would you rather pay a bit more each month for your premium to know that if you need care, your out-of-pocket costs will be minimal?

* A low deductible plan often provides this peace of mind. You budget for a higher monthly premium, but you gain predictability in what you’ll pay if you need to use your insurance.

* Are you interested in tax-advantaged savings?

* If you qualify for an HSA, a high deductible plan might be very attractive. HSAs offer a triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. It’s an excellent way to save for future healthcare costs, especially for retirement. (Remember to check the HSA deductible limit for the current year, as there are minimum deductibles required to be eligible for an HSA).

A Simple Checklist to Help You Decide

Let’s put it all together. Use these questions to guide your decision:

A High Deductible Plan (and possibly an HSA) might be good for you if:

* ✅ You are generally healthy and don’t anticipate frequent doctor visits.

* ✅ You want the lowest possible monthly health insurance bill.

* ✅ You have a comfortable emergency fund (or can quickly build one) that could cover your entire deductible if needed.

* ✅ You are interested in the tax benefits and long-term savings potential of a Health Savings Account (HSA).

* ✅ You are comfortable paying more out-of-pocket for medical care until your deductible is met.

A Low Deductible Plan might be good for you if:

* ✅ You expect to need medical care regularly (e.g., specialists, therapy, ongoing prescriptions).

* ✅ You have a chronic medical condition that requires frequent monitoring or treatment.

* ✅ You have young children who might need unexpected doctor visits.

* ✅ You prefer the predictability of higher monthly premiums but lower costs when you actually use your insurance.

* ✅ You do not have a large emergency fund to cover a high deductible, and prefer to spread your healthcare costs out over monthly premiums.

Out-of-Pocket Maximum: Your Ultimate Safety Net

Before we wrap up, there’s one more super important term you need to know: the out-of-pocket maximum.

This is the absolute most you will have to pay for covered medical services in a given plan year. Once you hit your out-of-pocket maximum, your health insurance plan will pay 100% of all further covered medical expenses for the rest of that year.

* Your deductible is part of your out-of-pocket maximum.

* Copayments and coinsurance also count towards it.

The out-of-pocket maximum is your ultimate financial protection against catastrophic medical bills. Even with a high deductible, knowing your out-of-pocket maximum gives you peace of mind that you won’t face unlimited costs.

Conclusion: Empowering Your Choice

You’ve done it! You now have a much clearer understanding of what a deductible is and how it impacts your health insurance.

There is truly no single “good deductible for health insurance” that fits everyone. The best deductible is the one that perfectly balances your monthly budget (what you can afford for premiums) with your ability to handle potential medical expenses (what you can pay out-of-pocket if something unexpected happens).

By carefully considering your health needs and your financial situation, and by understanding the trade-offs between high vs. low deductible plans, you can make an informed decision. You now have the knowledge to choose a health plan that not only protects your health but also your financial well-being.

You’ve got this! Choose confidently!