Can I Insure a Car Not in My Name? A Complete Guide

It’s a frequent and often stressful question: “Can I insure a car not in my name?” You might be a student driving a car your parents own, or perhaps you share a vehicle with a partner whose name is the only one on the title. In these common situations, getting the right insurance can feel confusing. This guide will provide a clear answer by explaining the most important rule in auto insurance: “insurable interest.”

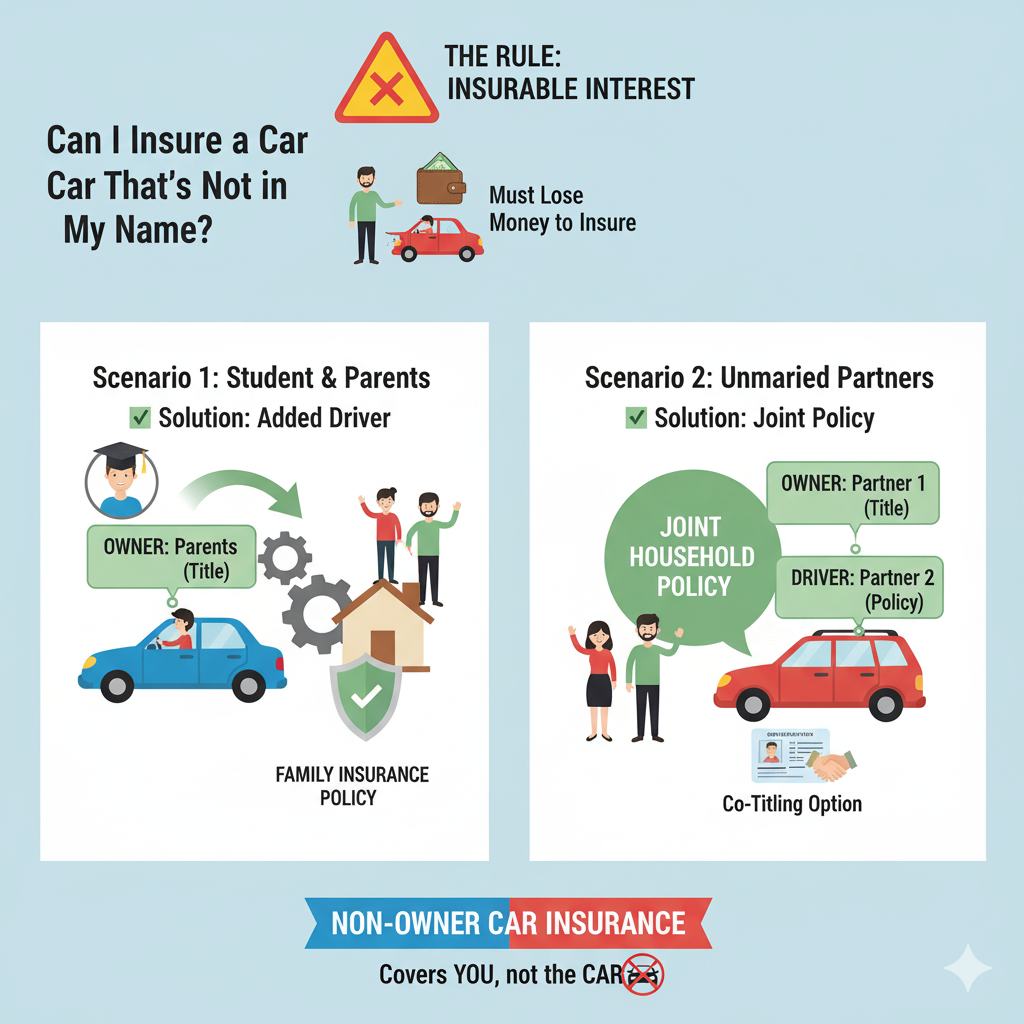

The #1 Rule You Must Understand: “Insurable Interest”

To understand car insurance, you must first understand the concept of insurable interest. This is the core principle that determines who can buy a policy.

In simple terms, insurable interest means you must have a direct financial stake in the vehicle. You must stand to suffer a direct financial loss if the car is damaged, stolen, or destroyed. The person who legally owns the car—the name on the title—is the one with the clearest insurable interest.

Think of it this way: you can’t buy insurance on your neighbor’s car because if they get into an accident, you don’t lose any money. They do. Insurance companies are set up to compensate the person who actually incurred the loss. This rule is the primary reason why it is difficult to insure a car not in your name.

Solutions When You Need to Insure a Car Not in My Name

While the general rule is strict, there are standard, industry-approved solutions for nearly every common scenario. Here’s how to handle it correctly.

Scenario 1: You’re a Student Driving Your Parent’s Car

This is the classic example. You’re living at home or away at college driving a car registered to your parents.

The Solution: Be Added as a “Named Driver.” This is the simplest and correct approach. Your parents, as the legal owners, must maintain the insurance policy. They simply need to contact their insurer and add you to their policy as a “listed driver” or “named driver.” This extends their full coverage to you. It’s the proper way to handle coverage for a family vehicle.

Scenario 2: You Live with Your Partner (Unmarried) and Share a Car

You and your partner live at the same address and share a vehicle that is only titled in one of your names.

The Solution: A Joint Policy or Co-Titling. Most insurance carriers will allow both of you to be on the same policy, as long as you share a residence. The car’s legal owner will be the “primary named insured,” and the partner will be listed as an additional driver. This ensures everyone in the household who drives the car is covered. For a more permanent solution, you can look into adding the second partner’s name to the vehicle’s title, which gives both of you insurable interest.

What About “Non-Owner Car Insurance“?

Many people think “non-owner insurance” is the answer when they want to insure a car not in their name, but this policy serves a very different purpose.

A non-owner policy is designed for people who don’t own a car but borrow or rent vehicles frequently. It provides liability coverage for damages you cause to other people while driving a borrowed car.

Crucially, it provides zero physical damage coverage (collision or comprehensive) for the car you are actually driving. It protects your assets from a lawsuit; it does not protect the car itself.

The Bottom Line: Why Insurance Companies Care Who Owns the Car

Insurers enforce the insurable interest rule for several key reasons:

- Risk Assessment: Premiums are calculated based on the owner and regular drivers. They need to know who owns the car to price the policy correctly.

- Legal Ownership: If a car is totaled in an accident, the insurance payout check is legally made out to the owner listed on the title. If the policy and title are in different names, it creates a legal and logistical nightmare.

- Fraud Prevention: The rule prevents situations where someone could insure a vehicle they don’t own and have a financial incentive for it to be damaged.

Conclusion

So, to recap the main question of whether you can insure a car not in your name, the answer is generally no due to the “insurable interest” rule. Attempting to get a separate policy on a car you don’t own will almost always be denied or lead to a rejected claim.

However, the best solutions are almost always to be added as a driver to the owner’s existing policy or to have your name added to the car’s title. These are the straightforward, insurer-approved methods to ensure you are properly and legally covered on the road.