Does Renters Insurance Cover Car Break Ins? The Surprising Answer

Does renters insurance cover car break ins

It’s a horrible, sinking feeling. You return to your parked car only to find a pile of shattered glass on the pavement. Your window is broken, your glove box is ransacked, and your backpack—with your laptop inside—is gone. It’s a frustrating and violating experience.

After the initial shock, the big question hits: “Who pays for this?” Your first instinct is probably to call your auto insurance company. But what about your renters policy? The answer often surprises people.

So, does renters insurance cover car break ins for the items that were stolen? In many cases, yes, it absolutely does.

This guide will walk you through this crucial distinction, explaining what each policy is designed to protect and what to do if this happens to you.

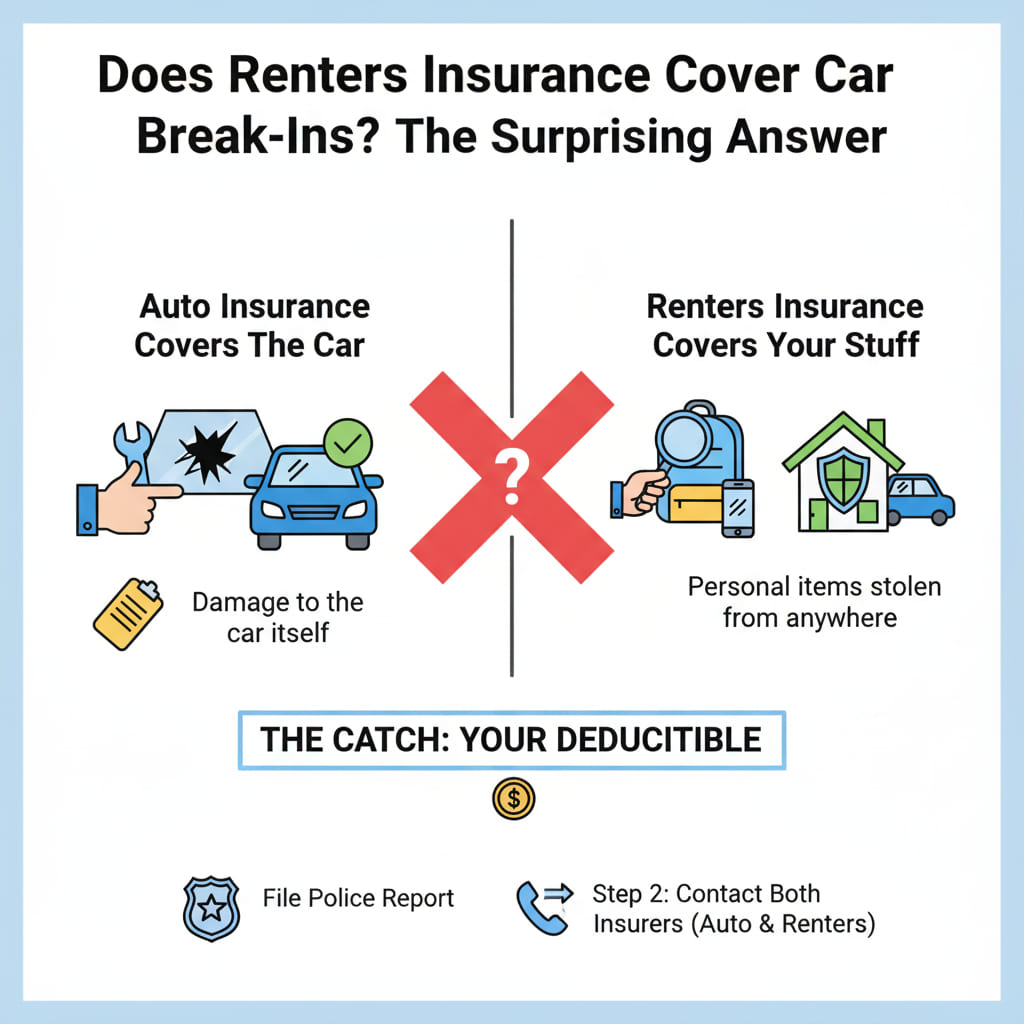

The Key Distinction: Your Car vs. Your Stuff

The easiest way to understand this is to mentally separate the car itself from the belongings you put inside it. These two categories are protected by two completely different insurance policies.

1. Auto Insurance (Specifically Comprehensive Coverage)

Your auto insurance policy is designed to protect the vehicle. This means the policy covers the car itself and any parts that are permanently attached or factory-installed.

This coverage, known as car insurance comprehensive coverage, pays for non-collision-related damage, including:

- The broken window.

- The damaged door lock or ignition from the break-in.

- A stolen stereo, if it was factory-installed. (An aftermarket one you put in yourself is often considered personal property).

2. Renters Insurance (Personal Property Coverage)

Your renters insurance policy is designed to protect your personal belongings. This coverage, officially called renters insurance personal property coverage, is the part of your policy that makes renters insurance so valuable.

Here’s the key: This coverage follows your stuff wherever it goes.

Your belongings are protected whether they are inside your apartment, in a storage unit, with you on vacation, or locked in your car.

This coverage applies to items like:

- Your laptop, phone, or tablet.

- Your gym bag and expensive athletic wear.

- Your sunglasses, textbooks, or tools.

- Any stolen items from car that are not part of the car itself.

So, to put it simply: Auto insurance protects the car, and renters insurance protects your contents.

How Does Renters Insurance Cover Items Stolen From Your Car?

This is the part that many people don’t realize they’re paying for. Your renters policy isn’t just for a fire in your apartment; it’s for the protection of your belongings everywhere.

It’s “Off-Premises” Coverage

In your policy documents, your renters insurance personal property coverage (often called “Coverage C”) almost always includes “off-premises” protection. This means your belongings are covered even when they are away from your rented home.

So, when your laptop is stolen from your car parked at the grocery store, it is protected by your renters policy, just as if it had been stolen from your living room.

The Big “But”: Your Deductible

Before you file a claim for your stolen $100 headphones, you must understand your deductible. An insurance deductible is the amount of money you have to pay out-of-pocket before your insurance company’s coverage kicks in.

Let’s use a clear example:

- Your Loss: Thieves break into your car and steal a backpack containing a $1,300 laptop and a $300 tablet. Your total loss is $1,600.

- Your Deductible: Your renters insurance policy has a $500 deductible.

- The Payout: When you are filing renters insurance claim for theft, you would be responsible for the first $500 of the loss. Your insurance company would then issue you a check for the remaining $1,100.

Now, let’s say only your $300 tablet was stolen. Since the value of your loss ($300) is less than your deductible ($500), it would not make financial sense to file a claim. You would be responsible for replacing the item yourself.

Coverage Limits and Sub-Limits

It’s also important to know your coverage limits. Your policy might cover, for example, $30,000 worth of personal property in total. However, most policies have sub-limits for specific categories of high-value items.

Common sub-limits include:

- Electronics: Your policy might have a $1,500 limit for all electronics.

- Jewelry: Coverage for jewelry theft is often limited to $1,00g or $1,500.

- Firearms: These also typically have a specific, lower limit.

If you own items that are more valuable than these sub-limits (like a $5,000 engagement ring or a $3,000 high-end laptop), you should talk to your agent about “scheduling” them. Scheduling an item (also called an “endorsement” or “rider”) insures it for its full-appraised value.

What Does Car Insurance Cover During a Break-In?

So, what is your auto insurance for? It’s for the physical damage to the vehicle itself.

As mentioned, this falls under car insurance comprehensive coverage. This is the part of your auto policy that covers non-collision events like theft, vandalism, fire, hail, and falling objects.

After a break-in, your comprehensive coverage would pay for:

- Replacing the shattered window.

- Repairing the broken door lock.

- Replacing a factory-installed navigation or stereo system if it was stolen.

Just like your renters policy, your auto policy has its own deductible for comprehensive coverage. It’s very common to have a $250, $500, or even $1,000 deductible. You must pay this amount before your auto insurer pays for the car’s repairs.

Filing a Claim: Renters vs. Auto Insurance

Okay, so you’ve got a broken window and a stolen laptop. This means you will likely have to file two separate claims with two different insurance companies.

It’s a hassle, but here is the process:

- Step 1: File a Police Report. Before you even call your insurance, call the non-emergency police line and file a report. Your insurance companies will require this report to process a theft claim. Get a copy of the report number.

- Step 2: Document Everything. Safely take photos and videos of the broken window, the damage inside the car, and the glass on the ground. Make a list of every single item that was stolen, and try to find receipts or serial numbers if you have them.

- Step 3: Call Your Auto Insurance Company. File a claim under your comprehensive coverage for the damage to the car (the window, the lock). You will be responsible for your auto policy’s deductible.

- Step 4: Call Your Renters Insurance Company. File a separate claim under your personal property coverage for the stolen belongings. You will be responsible for your renters policy’s deductible.

Yes, this means that in this “worst-case” scenario, you may have to pay both deductibles. This is why it’s so important to know your deductible amounts and weigh them against the value of your loss before filing.

Conclusion : does renters insurance cover car break ins

It’s an incredibly frustrating experience, but knowing where to turn for help makes it a little easier.

Here’s the key takeaway: While your auto insurance fixes the car’s damage (like the broken window), it’s typically your renters insurance that protects your belongings (like your stolen laptop), even when they’re taken from your car.

Understanding this key difference helps you ensure you have the right coverage in place. Check your renters insurance personal property limits and your deductibles today, so you know exactly what you’re protected against before you ever need to file a claim.