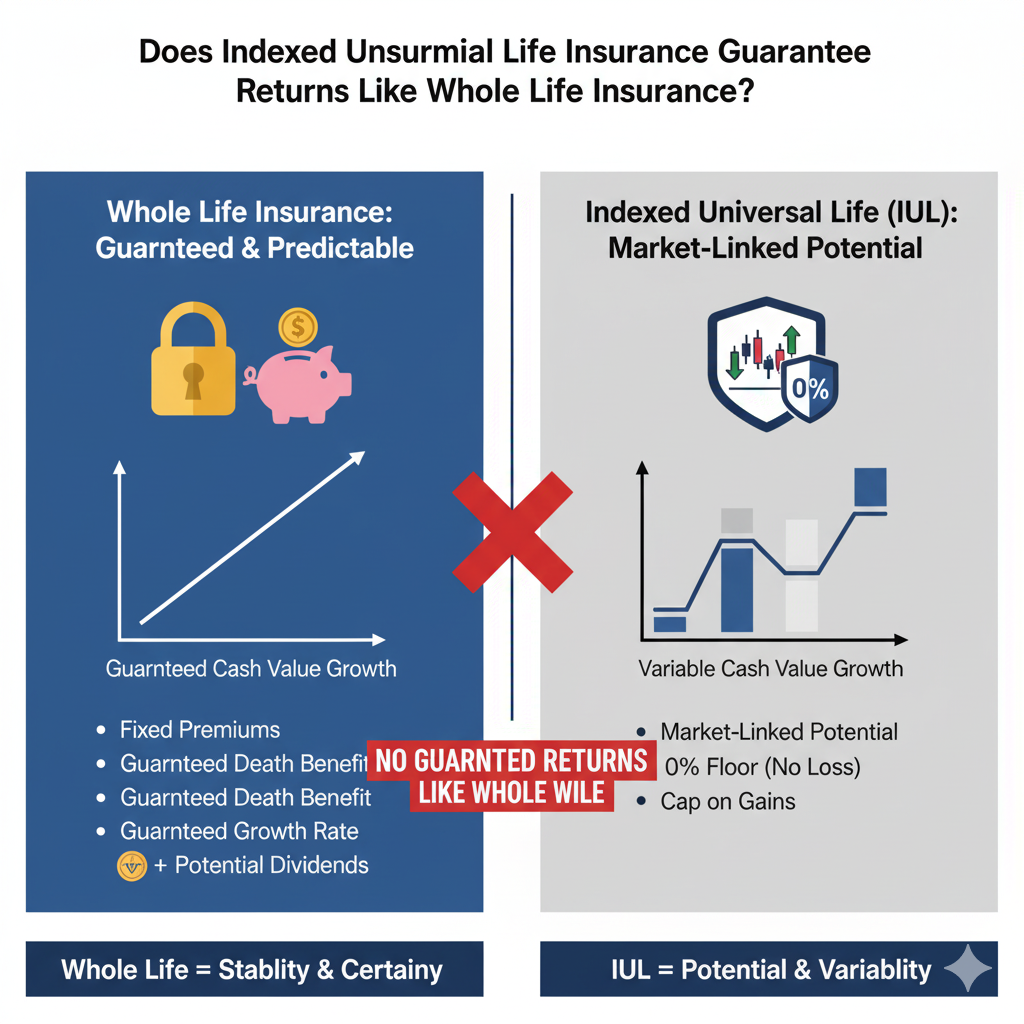

Does Indexed Universal Life Insurance Guarantee Returns Like Whole Life Insurance?

Does Indexed Universal Life Insurance Guarantee Returns Like Whole Life Insurance?Does Indexed Universal Life Insurance Guarantee Returns Like Whole Life Insurance?

Feature Whole Life Insurance Indexed Universal Life (IUL)

Premiums Fixed & Guaranteed: The amount is set and will never change. Flexible: You can often adjust premium payments within certain limits.

Cash Value Growth Guaranteed: A contractually guaranteed minimum fixed interest rate, plus potential non-guaranteed dividends. Variable: Linked to a market index. Returns are not guaranteed and can be 0% in a given year.

Growth Potential Lower but Predictable: Growth is steady and reliable. Higher but Variable: Has the potential to outperform Whole Life in strong market years, but will underperform in flat or negative years.

Risk Level Very Low: The cash value growth is contractually guaranteed by the insurance carrier. Moderate: You are protected from market losses (0% floor), but you risk years of 0% growth, which can impact long-term performance.

Guarantees Ironclad: Guaranteed premiums, death benefit, and cash value growth. Partial: The death benefit is guaranteed (assuming premiums are paid), and the floor provides a guarantee against market loss, but there is no guarantee of positive returns.

Complexity Simple: Fewer moving parts and easy to understand. Complex: Caps, floors, participation rates, and rising internal costs of insurance require careful management and understanding.