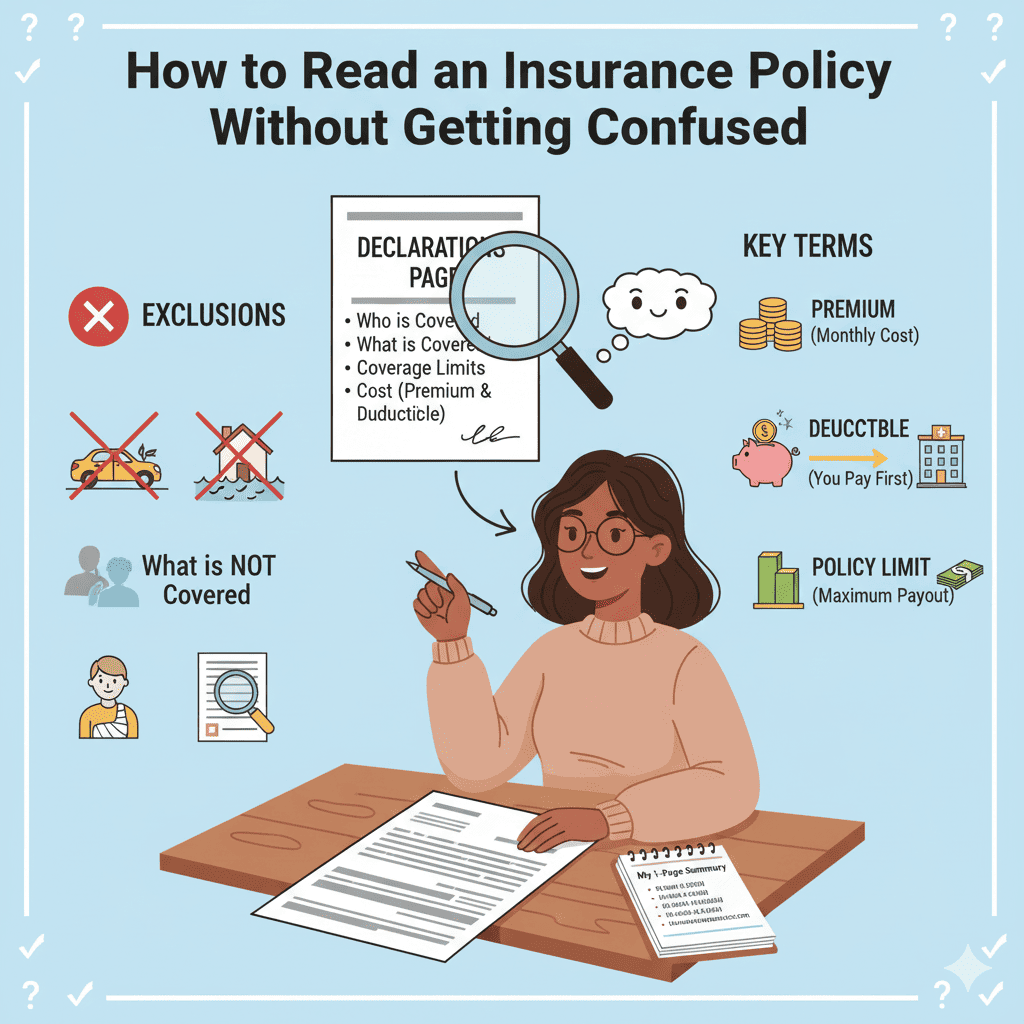

How to Read an Insurance Policy Without Getting Confused

You’ve just received a 50-page insurance policy in the mail or your inbox. You open it, and your eyes glaze over. It’s full of dense legal text, strange terms, and endless paragraphs. Where do you even begin?

Don’t worry. You are not alone, and you absolutely do not need to read every single word to understand what you’ve purchased.

Think of your insurance policy not as a scary legal contract, but as the “user manual” for your financial safety net. Your job isn’t to memorize it, but to know where to find the most important settings. This guide will teach you how to read an insurance policy by focusing on just a few key sections that truly matter.

Before You Start: The 4 Key Sections of Any Policy

The good news is that almost all understanding insurance documents comes down to knowing their basic structure. Whether it’s for your car, apartment, or health, policies are generally built the same way. Here are the four parts of your “user manual”:

- The Declarations Page: This is the “cheat sheet” or summary. It’s the most important page and is personalized just for you.

- The Insuring Agreement: This is the company’s main promise. It’s the section that describes in broad terms what the policy will actually cover.

- The Exclusions: This is the fine print. It’s the list of specific things, situations, or events that are NOT covered by the policy.

- The Conditions: These are the rules of the road. This section explains the responsibilities you must uphold to keep your coverage active (like paying your premium on time).

That’s it! By knowing these four sections exist, you already have a mental map of your policy.

Decoding the 5 Most Important Words in Your Policy

Before we walk through the steps, let’s learn a few key vocabulary words. Getting these right is half the battle. This is a mini-glossary of insurance terms for beginners.

- Premium: This is simply the price of your insurance policy. It’s the amount you pay every month, every six months, or once a year to keep your coverage active.

- Simple Example: If your car insurance costs $1200 per year, your premium could be $100 per month.

- Deductible: This is the amount of money you must pay out-of-pocket for a claim before the insurance company starts paying. Think of it as your entry fee to use your insurance.

- Simple Example: Your car has $4,000 in damage from an accident, and your collision deductible is $500. You pay the first $500, and your insurance company pays the remaining $3,500.

- Co-pay / Co-insurance: This is most common in health insurance. It’s your share of a medical bill after your deductible has been met. A co-pay is a flat fee (like $25 for a doctor visit), while co-insurance is a percentage (you pay 20% of the bill, the insurer pays 80%).

- Policy Limit (or Coverage Limit): This is the maximum amount your insurance company will pay for a single claim or during a policy period. Once you hit this ceiling, you are responsible for any remaining costs.

- Simple Example: Your renters insurance has a $20,000 limit for personal property. If a fire destroys $25,000 worth of your belongings, the insurance will pay a maximum of $20,000.

- Exclusions: These are the specific things your policy will not cover. Reading this section is crucial for managing your expectations.

A 3-Step Method on How to Read an Insurance Policy Like a Pro

Ready to tackle that document? Don’t start on page one. Follow this simple, three-step method to get straight to the information that matters most.

Step 1: Start with the Declarations Page

This is your new best friend. The policy declaration page is usually the very first page of your policy, and it’s your personalized cheat sheet. It summarizes all the critical information in one place. If you read nothing else, read this page carefully.

It will tell you:

- Who is insured (your name and address).

- What is insured (your car’s VIN, your home’s address).

- How much coverage you have (your policy limits).

- How much it costs (your premium and deductibles).

- When your coverage is active (the policy effective dates).

This one page answers 90% of the questions most people have about their coverage.

Step 2: Read the “Exclusions” Section Next

This might sound backward, but this is a pro tip. Before you dive into the long pages describing what’s covered, flip to the insurance exclusions explained section to see what is NOT covered.

Why? Because it manages your expectations. Knowing that your homeowners insurance doesn’t cover flood damage, or your auto policy doesn’t cover mechanical breakdowns, is critical information. Reading the exclusions prevents a lot of frustration and disappointment if you ever have to file a claim.

Step 3: Check Your Coverage Limits

Go back to your Declarations Page and look closely at the policy limits. Ask yourself a simple question: “Is this number enough?”

- For auto insurance, is your liability limit high enough to protect your assets in a major accident?

- For homeowners insurance, is your dwelling coverage limit enough to rebuild your home after a total loss?

- For renters insurance, is your personal property limit enough to replace all your stuff?

Your policy limits define the ultimate value of your safety net. Make sure they are high enough to give you real peace of mind.

A Golden Tip to Save You Future Headaches

Here’s a final piece of advice I give everyone. Once you’ve reviewed your policy, take five minutes and create your own one-page summary in your own words.

Grab a piece of paper or open a note on your phone and write down:

- Policy Number:

- Insurance Company’s 24/7 Claims Phone Number:

- My Deductibles: (e.g., Auto Collision: $500, Home: $1,000)

- My Key Coverage Limits: (e.g., Auto Liability: $100k/$300k, Home Dwelling: $350k)

- Policy Renewal Date:

Save this somewhere you can easily find it, like in your phone’s contacts or taped inside a kitchen cabinet. In a stressful emergency, this simple sheet will be far more helpful than a 50-page document.

Conclusion

See? It’s not so scary when you know where to look. An insurance policy might seem intimidating, but it’s just a document. By ignoring the noise and focusing on the Declarations Page, Exclusions, and your Coverage Limits, you can get a solid grasp of your protection in less than 30 minutes.

By following these simple steps, you can confidently review any of your understanding insurance documents. You are now in control of your financial protection, and that is a great feeling.