I Had a Car Wreck Without Insurance: What Do I Do Now? A Step-by-Step Guide

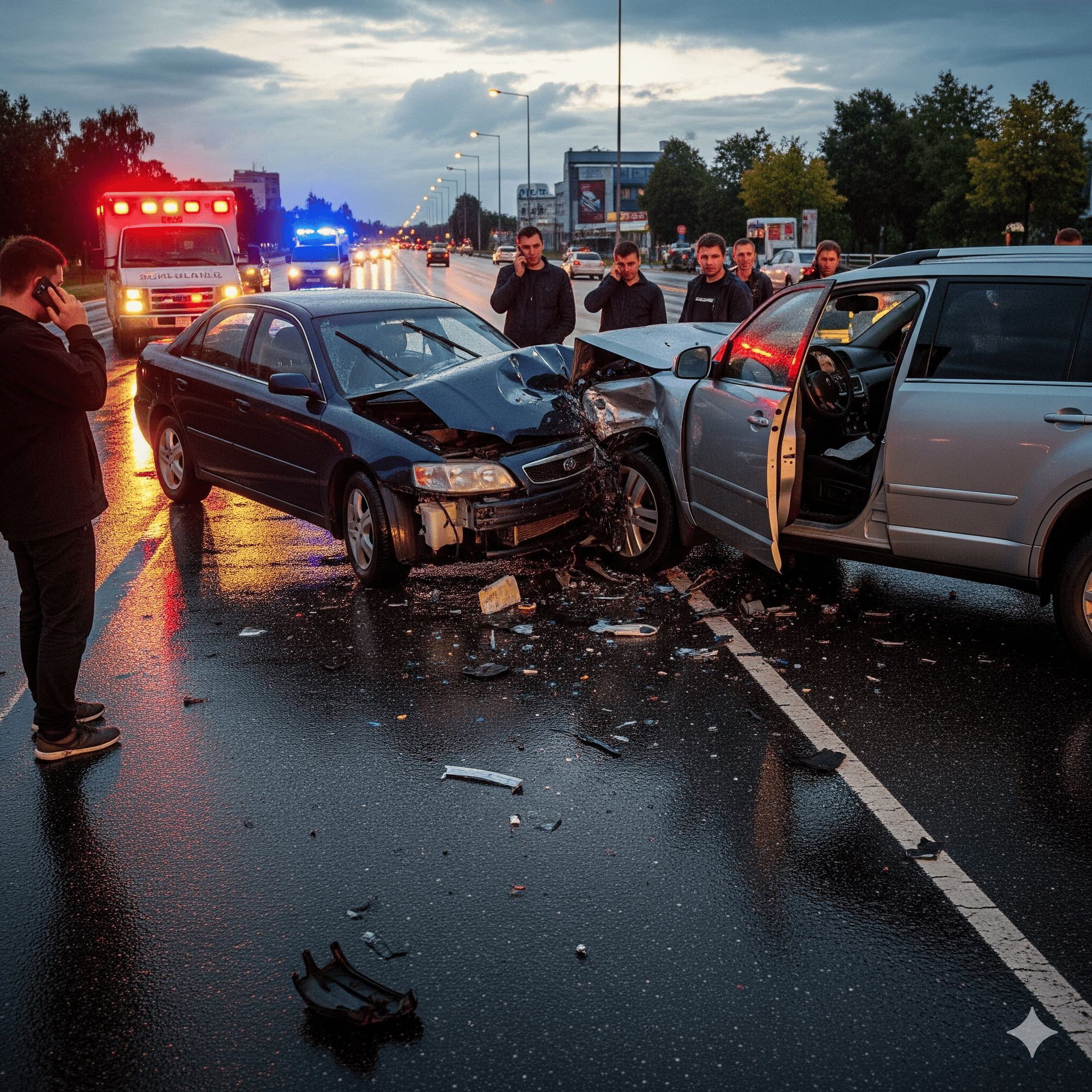

Getting into a car wreck is stressful. The sound of crunching metal, the jolt, the immediate worry about everyone’s safety—it’s an overwhelming experience. Realizing you don’t have insurance can turn that stress into pure panic.

Take a deep breath. Right now, it’s essential to stay calm and methodical. This is a serious situation, but it is one you can navigate. This guide will walk you through exactly what to do after a car wreck without insurance, one step at a time.

Immediate Steps at the Scene of the Accident

What you do in the first few moments and minutes after an accident can significantly impact the outcome. Your priority is safety and information gathering. Follow these steps precisely.

1. Check for Injuries Before you do anything else, check on yourself, your passengers, and the people in the other vehicle. If anyone is hurt, call 911 immediately. Nothing is more important than health and safety.

2. Move to a Safe Location If the accident is minor and the cars are drivable, move them to the side of the road and out of traffic. Turn on your hazard lights. This prevents further accidents and keeps everyone safer. If the cars cannot be moved, get yourself and any passengers to a safe spot away from the roadway while you wait for help.

3. Call the Police This step is non-negotiable. You might feel tempted to avoid calling the police because you don’t have insurance. Do not make this mistake. A police report is an official, unbiased record of the accident. It documents the scene, gathers statements, and often includes a preliminary determination of fault. Without it, you leave yourself vulnerable to a “he said, she said” situation later.

4. Exchange Information (and Be Honest) You need to exchange the following information with the other driver:

- Full Name and Contact Information (address, phone number)

- Driver’s License Number

- License Plate Number

- Make, Model, and Color of their Vehicle

- Their Auto Insurance Company and Policy Number

When it’s your turn to provide information, you must be honest. State calmly and clearly that you do not currently have insurance. Lying or providing false information can lead to severe legal penalties, including fraud charges, making a bad situation much worse.

5. Document Everything Your smartphone is your best tool here. Take pictures and videos of everything you can, including:

- Damage to both vehicles from multiple angles.

- The entire accident scene, including skid marks, debris, and traffic signs.

- The other driver’s license plate and insurance card (if they’ll let you).

- Any visible injuries.

If there are witnesses, ask for their names and phone numbers. Their testimony could be incredibly valuable.

What Happens if You Are At Fault?

This is the most challenging scenario. If you caused the at-fault accident, you are personally and financially responsible for the damages and injuries you caused. Here’s what you can expect.

Financial Consequences Since you don’t have an insurance company to pay for the other driver’s losses, the bill falls directly to you. This includes:

- The cost to repair or replace their vehicle.

- Their medical bills, including ambulance rides, hospital stays, and rehabilitation.

- Lost wages if they are unable to work due to their injuries.

The other driver’s insurance company will likely pay for their client’s initial damages and then come to you to recover that money. This process is called subrogation. You will receive letters and calls from them demanding payment.

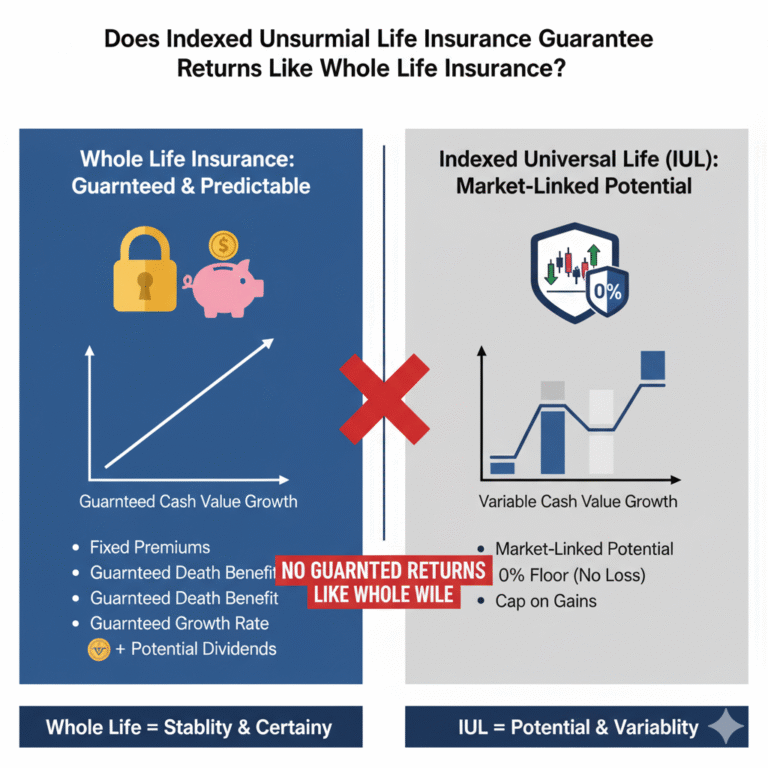

Legal Penalties Driving without insurance is illegal in nearly every state. In addition to being responsible for the accident costs, you will face penalties from your state’s DMV. These can include:

- Significant fines, often hundreds or even thousands of dollars.

- Suspension of your driver’s license and vehicle registration.

- In some states, your vehicle may be impounded.

- A requirement to file an SR-22 certificate for several years, which is a special form that proves you have insurance. This will make it more expensive to get coverage in the future.

What if the Other Driver Was At Fault?

If the other driver caused the crash, you have a much clearer path to getting your damages covered. However, not having insurance can still complicate things.

Your main option is filing a claim without insurance of your own. You will file a “third-party claim” directly with the at-fault driver’s insurance company. You will use the information you collected at the scene to contact their insurer and start the process. Their insurance should cover your vehicle repairs and medical expenses up to their policy limits.

However, be aware of “No Pay, No Play” laws. In several states (like California, Louisiana, and Michigan, among others), if you are driving uninsured and get into an accident, your ability to recover certain damages is limited—even if the other driver was 100% at fault. These laws might prevent you from suing for non-economic damages, such as “pain and suffering.” You can still typically claim for direct costs like car repairs and medical bills.

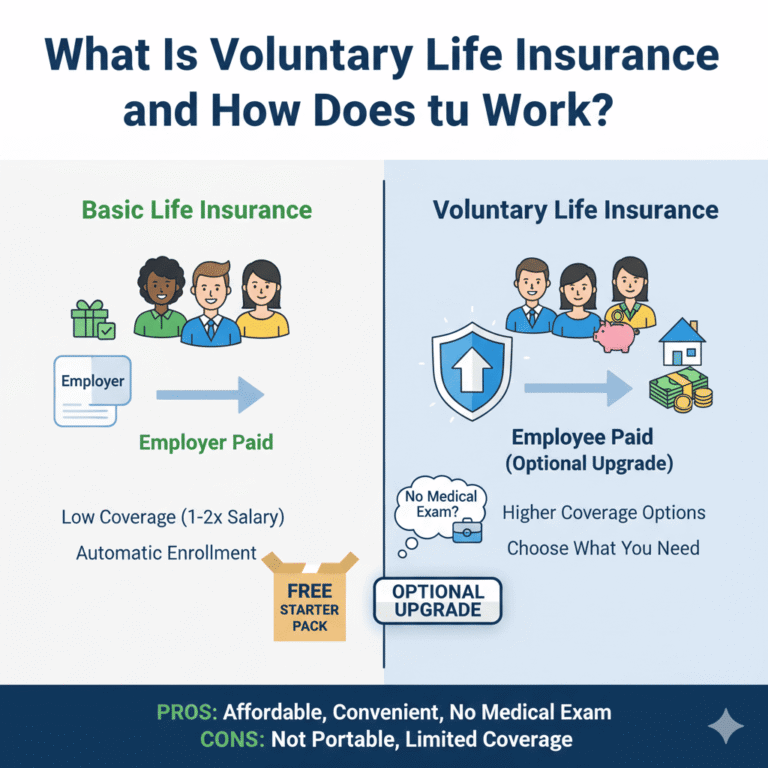

It’s also important to understand the term uninsured motorist coverage. This is a type of coverage the other driver might have on their policy. It protects them if they are hit by someone without insurance (like you). It does not provide any benefit or coverage to you.

Dealing with a Car Wreck Without Insurance: Your Financial Responsibility

Regardless of who was at fault, you are responsible for 100% of the repair costs for your own vehicle.

If you were at fault, you are also responsible for the other party’s damages. When their insurance company contacts you for payment, do not ignore them. Ignoring the problem will only lead to them taking more aggressive action, like sending the debt to a collections agency or filing a lawsuit.

Instead, communicate with them. You may be able to negotiate a settlement for less than the full amount or, more likely, work out a long-term payment plan. This is a crucial part of paying for damages out of pocket and can prevent the situation from escalating to a legal judgment against you.

Can You Be Sued? And What Should You Do?

Yes, you can be sued. If you were at fault, the other driver or their insurance company has the right to file a lawsuit against you to recover their costs. Suing an uninsured driver is a common way for insurance companies to recoup their losses.

If you are served with a lawsuit, you cannot ignore it. Failing to respond will likely result in a default judgment against you, which means you automatically lose the case. A judgment can result in:

- Wage garnishment (money being taken directly from your paycheck).

- Bank account levies.

- A lien being placed on your property.

If you receive a letter from an attorney or are formally sued, you should seriously consider consulting with a lawyer. A legal professional can explain your rights, evaluate any settlement offers, and help you navigate the court process.

Conclusion: Your Next Steps Are Crucial

Navigating a car wreck without insurance is one of the most stressful financial and legal challenges a person can face. The key is to handle it head-on. Stay calm, be honest, document everything, and communicate with the other parties involved.

This experience is a painful lesson on the importance of auto insurance. It isn’t just a piece of paper or a monthly bill—it’s a critical financial shield that protects you from devastating liability. It is also a legal requirement for a reason.

Your number one priority, as soon as you are able, should be to get an auto insurance policy. You can get through this, and the most important step you can take for your future is to ensure it never happens again.