Insurance for Churches in Alabama: A Complete Guide (2025)

A church is more than a building; it is a cornerstone of the community, a place of worship, and a center for fellowship and service. Protecting this vital mission from unforeseen risks is one of the most important responsibilities of church leadership. Understanding the unique insurance needs of a ministry can be complex, but it is an essential act of stewardship. This guide is designed to break down the essentials of insurance for churches in Alabama, ensuring you can make informed decisions to protect your congregation, staff, assets, and outreach.

Is Insurance Legally Required for Churches in Alabama?

This is a common and important question. In Alabama, there is no single state law that mandates a “church insurance” policy. However, this does not mean a church can operate without any coverage. Certain insurance types are legally required based on your church’s specific operations:

- Workers’ Compensation Insurance: If your church has employees—including full-time pastors, part-time administrative staff, musicians, or maintenance personnel—you are required by Alabama state law to carry workers’ compensation insurance. This coverage is not optional.

- Commercial Auto Insurance: If the church owns and operates any vehicles, such as a van, bus, or car titled in the church’s name, you must carry commercial auto liability insurance that meets Alabama’s minimum requirements. Personal auto policies do not cover vehicles owned by an organization.

While other coverages may not be legally mandated, they are essential for protecting the church from financial devastation in the event of an accident, lawsuit, or disaster.

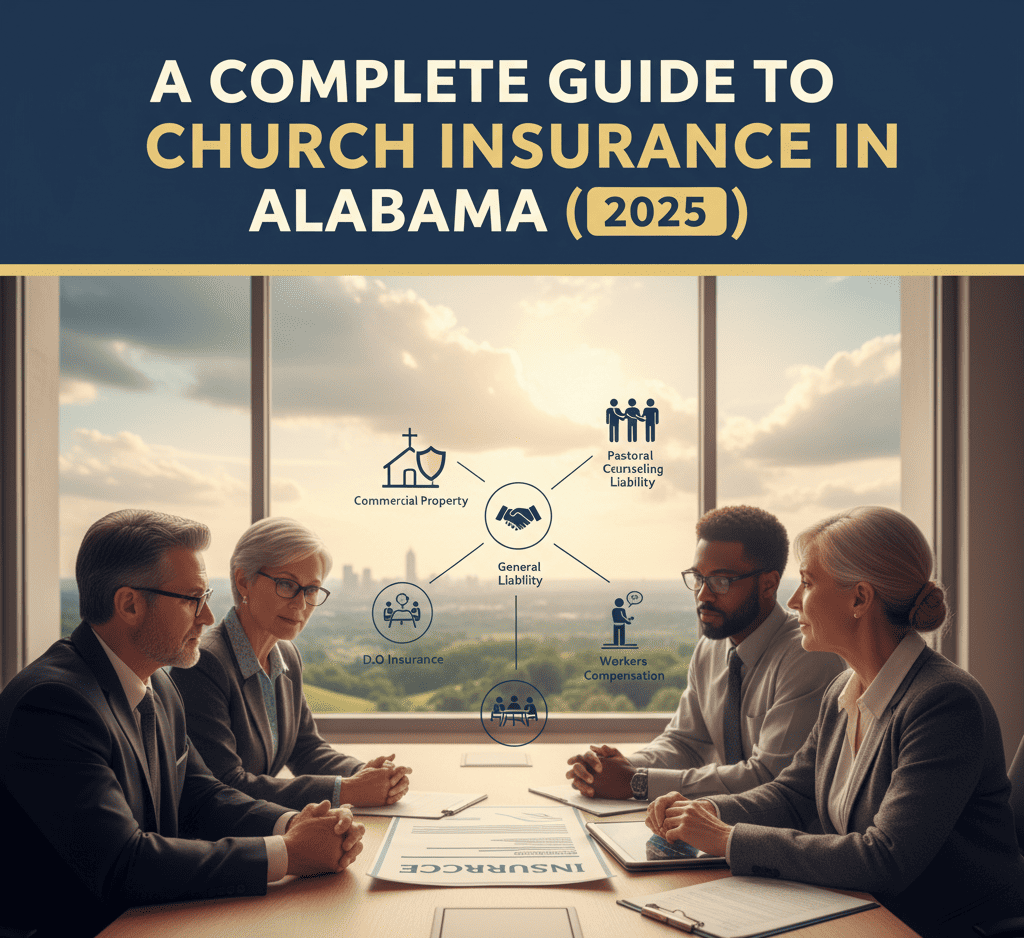

The 5 Essential Types of Insurance for Churches in Alabama

A well-protected ministry needs a package of policies tailored to its unique risks. While every church is different, these five coverages form the foundation of a strong insurance program for any religious organization.

1. General Liability Insurance

This is the cornerstone policy that protects your church against claims of bodily injury or property damage that occur on your grounds or as a result of your activities. Think of it as your “slip and fall” coverage. General Liability is crucial because a church welcomes many people onto its property for services, meetings, and events.

- What it covers: Medical expenses for a visitor injured on your property, legal defense costs if your church is sued after an accident, and damages awarded in a lawsuit.

- Example: A member of the congregation slips on a wet floor in the fellowship hall and breaks their arm. Your church liability insurance in Alabama would cover their medical bills and any associated legal costs if a claim is filed.

2. Commercial Property Insurance

This policy protects the physical assets of your church. It covers the church building itself, as well as everything inside it, from catastrophic events like fire, theft, wind, or vandalism. For most ministries, their property is their single largest asset.

- What it covers: The main church building, sanctuaries, classrooms, administrative offices, and separate structures like fellowship halls. It also covers the contents, including pews, pulpits, sound systems, computers, musical instruments, and important documents.

- Example: A severe thunderstorm causes a tree to fall on your church’s roof, leading to significant structural and water damage. Property insurance for churches would pay for the repairs to the building and the replacement of damaged contents.

3. Pastoral Counseling Liability

This is a critical, specialized coverage that standard general liability policies do not include. Pastors and ministry leaders often provide spiritual guidance and counseling to members of their congregation. Pastoral Counseling Liability is a form of professional liability (or “errors and omissions”) insurance designed to protect them in this role.

- What it covers: Defends against claims alleging that a pastor or counselor provided negligent or harmful advice that resulted in emotional or financial harm.

- Example: A couple receives marital counseling from a pastor. They later divorce and sue the pastor and the church, claiming the advice they received worsened their situation. This policy would cover the legal defense costs and any settlement.

4. Directors & Officers (D&O) Insurance

Your church is governed by a board of directors, trustees, or elders who make important financial and management decisions. Directors & Officers (D&O) Insurance protects these individuals from lawsuits that may arise from their decisions on behalf of the church.

- What it covers: Legal defense for board members who are personally named in a lawsuit alleging mismanagement of funds, wrongful employment practices, or failure to govern the organization properly.

- Example: A donor sues the church board, claiming their designated donation was used improperly. D&O insurance would protect the personal assets of the board members during the ensuing legal battle. This is a vital component of any non-profit insurance in Alabama.

5. Workers’ Compensation Insurance

As mentioned, this coverage is mandatory in Alabama for any church with employees. Workers’ Compensation provides benefits to employees who get injured or become ill as a direct result of their job.

- What it covers: An employee’s medical bills, lost wages during recovery, and rehabilitation services. It also protects the church from being sued by the injured employee.

- Example: The church’s part-time custodian injures their back while moving heavy tables for an event. Workers’ comp would cover their medical treatments and a portion of their lost income while they are unable to work.

What Other Coverages Should Your Church Consider?

Beyond the essential five, several other policies can address specific risks your ministry may face:

- Commercial Auto Insurance: For any church-owned vehicles.

- Cybersecurity Insurance: To protect against data breaches of sensitive congregant and donor information.

- Religious Freedom/Expression Liability: Protects against claims of discrimination or emotional injury based on the church’s beliefs and practices.

- Special Event Insurance: For large community events, festivals, or concerts that may not be covered under your general liability policy.

How to Find the Best Insurance for Your Church in Alabama

Churches are not standard businesses; they are unique organizations with specialized risks. The best way to secure proper coverage is to partner with an insurance professional who understands the specific needs of ministries.

Look for an independent insurance agent or broker who specializes in religious organization insurance. Unlike a “captive” agent who only represents one company, an independent agent can compare policies and quotes from multiple carriers that are experts in insuring churches. They can help you conduct a risk assessment and build a customized insurance package that provides comprehensive protection without overpaying for coverages you don’t need.

Conclusion

Protecting your church with the right insurance is a foundational act of stewardship. It ensures that a single accident or lawsuit cannot derail the mission your ministry has worked so hard to build. A comprehensive plan requires a unique package of coverages that go far beyond a standard business policy, from general liability to highly specialized policies like pastoral counseling liability.

We encourage you to perform a thorough risk assessment of your church’s operations and speak with a qualified professional who specializes in insurance for churches in Alabama. Taking this proactive step will provide peace of mind and allow you to focus on what matters most: serving your congregation and your community.