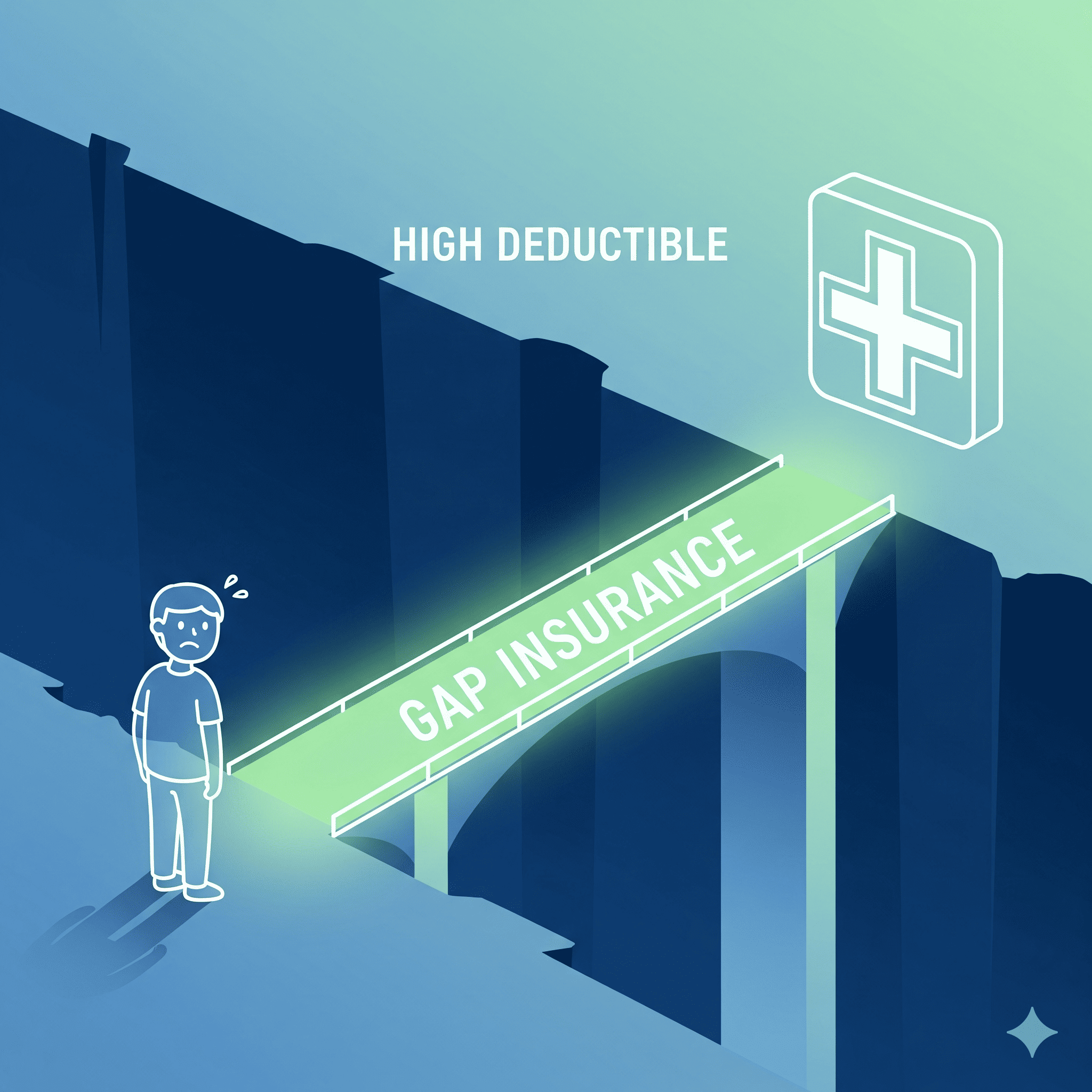

What is Gap Health Insurance and Who Actually Needs It?

You did it. You picked a health insurance plan, likely one with a great, low monthly premium. But then you saw it lurking in the details: the deductible. That daunting number—$5,000, $7,000, or even more—that you have to pay out-of-pocket before your main insurance kicks in. It’s enough to make anyone nervous.

What happens if you have an unexpected accident or illness? How are you supposed to cover that massive gap? This is where a lesser-known but powerful tool comes into play. If you’re wondering what is gap insurance for medical costs, you’re asking the right question.

This guide will explain in simple terms what gap health insurance is, how it works, and help you decide if it’s the financial safety net you need.

What is Gap Health Insurance? The Simple Answer

Think of gap health insurance as “insurance for your insurance.”

It’s a supplemental insurance policy designed to work alongside your primary health plan, specifically a high deductible health plan (HDHP). Its only job is to help you pay for your out-of-pocket costs, like your deductible, copayments, and coinsurance, so that a medical emergency doesn’t turn into a financial disaster.

It’s not a replacement for your main health insurance. It’s a teammate that helps cover the costs your primary plan requires you to pay first.

How Does Gap Insurance Actually Work? A Real-Life Example

The best way to understand gap coverage is to see it in action.

Let’s meet Sarah. She has a good HDHP with a low monthly premium, but her deductible is $6,000. She has a bicycle accident and needs to go to the hospital, resulting in a $10,000 medical bill.

- Scenario 1: Without Gap Insurance

- Sarah is responsible for her full $6,000 deductible.

- After she pays $6,000, her main insurance starts to cover the rest (let’s say 80%).

- She is still responsible for thousands of dollars out-of-pocket. This is a huge, stressful expense.

- Scenario 2: With Gap Insurance

- Sarah also pays for a gap insurance plan. Let’s say it has a small $500 deductible and covers up to $5,000 in costs.

- When she receives the $10,000 bill, she first pays her $500 gap plan deductible.

- Her gap insurance policy then pays $5,000 directly towards her main deductible.

- The remaining balance of her main deductible is now only $500 ($6,000 – $5,000 – $500). Sarah pays this.

- Her main insurance now kicks in to cover the rest of the bill.

In the end, Sarah’s total out-of-pocket cost was $1,000 instead of $6,000. That is a massive difference, and it’s why this coverage exists.

What Does Gap Insurance Typically Cover (and Not Cover)?

It’s crucial to know that gap insurance isn’t a free-for-all. It’s designed to cover the cost-sharing parts of your primary insurance.

It Generally Covers:

- Your primary health plan’s deductible

- Copayments for doctor visits or hospital stays

- Coinsurance percentages you’re responsible for

It Generally Does NOT Cover:

- Monthly premiums for your primary insurance plan

- Treatments that your primary insurance doesn’t cover

- Out-of-network provider costs

- Prescription drug costs

Who Actually Needs Gap Health Insurance?

This is the most important question. Is gap health insurance worth it for you? It depends entirely on your situation.

1. You Have a High-Deductible Health Plan (HDHP)

This is the number one reason to consider gap insurance. If you chose an HDHP for its low premiums but worry about being able to afford the high deductible in an emergency, a gap plan is designed specifically for you.

2. You Have a Family with Active Kids

If you have children who play sports or are just generally adventurous, the risk of unexpected trips to the emergency room for sprains, breaks, or stitches is higher. A gap plan can provide peace of mind.

3. You Have a Known, Upcoming Medical Procedure

If you or a family member have a planned surgery or treatment coming up, you know you will have to meet your deductible. A gap plan can be a financially savvy way to budget for those known costs.

4. You Don’t Have a Large Emergency Fund

Financial experts recommend having 3-6 months of living expenses saved. If your emergency fund is small and paying your full deductible would wipe it out, a gap plan acts as a financial buffer.

5. You Have a Chronic Health Condition

For those who need regular doctor visits, tests, or treatments, medical costs can add up quickly. A gap plan can help manage these predictable out-of-pocket expenses throughout the year.

Conclusion: A Safety Net for Peace of Mind

Gap health insurance isn’t for everyone. If you have a low-deductible plan or a large emergency fund, you may not need it.

But for millions of Americans with high-deductible plans, it serves as a valuable and affordable safety net. It’s a tool that allows you to enjoy the low monthly premiums of an HDHP without the constant worry of a massive, unexpected medical bill wiping out your savings. By covering the gap, it gives you the freedom to seek care when you need it with true peace of mind.