What Is Voluntary Life Insurance and How Does It Work?

It’s that time of year again—open enrollment. As you scroll through your company’s benefits portal, you see an option for Voluntary Life Insurance. You know your employer already provides a basic life insurance policy for free, so you’re probably wondering, “What exactly is this, and is it something I should pay for?”

It’s a great question, and you’re not alone in asking it. Many employees find this benefit a little confusing. This guide will break down exactly what voluntary life insurance is, how it works, and help you decide if it’s the right choice for you and your family.

What is Voluntary Life Insurance, Simply Put?

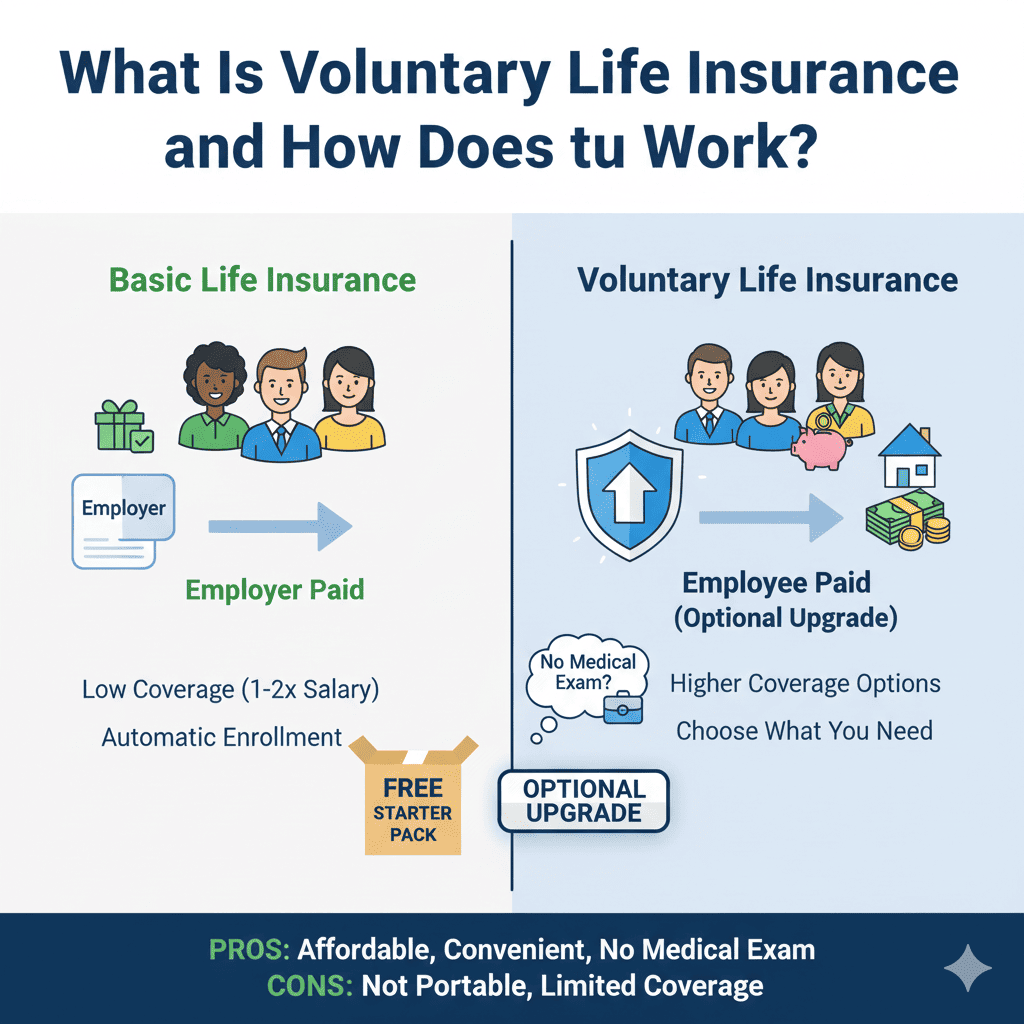

Let’s use a simple analogy. Think of the basic life insurance your employer provides as a “free starter pack.” It’s a great, no-cost benefit that offers a foundational level of protection.

Voluntary life insurance is the “optional upgrade.” It’s an additional life insurance policy you can choose to buy through your employer, typically at a competitive group rate. It allows you to increase your total coverage beyond the basic “starter pack” amount, giving your loved ones a much larger financial safety net.

You’ll often see it called supplemental life insurance, which is a perfect description—it’s meant to supplement the basic coverage your employer gives you. Because it’s offered to a whole group of employees, it’s a type of group life insurance.

Voluntary vs. Basic Group Life Insurance: What’s the Difference?

The easiest way to see the distinction is with a side-by-side comparison.

The Pros and Cons of Voluntary Life Insurance

Like any financial product, this type of employee life insurance has distinct advantages and disadvantages. Understanding these is key to deciding if it’s right for you.

The Pros (The Advantages)

- Incredible Convenience: This is a major benefit. You can sign up in minutes during open enrollment with no lengthy application process. The premiums are then handled automatically through payroll deductions. It’s a “set it and forget it” system.

- Affordable Group Rates: Because the insurer is selling policies to an entire group of employees, they can spread their risk out. This often results in lower monthly premiums than you might find if you were buying a similarly sized policy on your own.

- No Medical Exam (Usually): This is perhaps the biggest advantage. Most employers offer a “guaranteed issue” amount, which is a certain level of coverage (e.g., up to $150,000 or 3x your salary) that you can get without answering any health questions or taking a medical exam. This is a golden opportunity for individuals who might have health conditions that would make getting a private policy difficult or expensive.

The Cons (The Disadvantages)

- It’s Usually Not Portable: This is the single most important drawback to understand. In most cases, your voluntary life insurance policy is tied to your job. If you leave your company—whether you quit, are laid off, or retire—you typically lose your coverage. Some policies can be “converted” to an individual whole life policy, but the premiums for that converted policy are often significantly more expensive.

- Limited Coverage Options: The maximum amount of coverage you can purchase is often capped, for instance, at 5 times your salary or a specific dollar amount like $500,000. If you have significant financial obligations (like a large mortgage and young children), this might not be enough coverage for your needs.

- Rates May Not Be the Cheapest for Everyone: While the group rates are competitive, a young, perfectly healthy individual may be able to find a cheaper term life insurance policy by shopping around on the private market. The group rate is an average price for a diverse group of people.

So, Is Voluntary Life Insurance Worth It for You?

Now for the most important question. To figure this out, consider which of these scenarios sounds most like you.

Voluntary life insurance is likely a great choice for you if:

- You have underlying health conditions. The “no medical exam” feature is a fantastic way to get valuable coverage that might otherwise be unaffordable.

- You need more insurance than the basic plan. The free policy from your employer is a great perk, but 1x your salary is rarely enough to cover a family’s long-term needs. This is an easy way to boost that amount.

- You value convenience. If you want to get more coverage in place quickly without the hassle of shopping around and going through medical underwriting, this is the easiest way to do it.

- You need a “bridge” policy. It’s a great way to get coverage now while you take your time to shop for a long-term private policy.

You might be better off with a private policy if:

- You want long-term security. The biggest benefit of a private term life insurance policy is that it’s yours. It stays with you no matter how many times you change jobs, as long as you pay the premium.

- You are young and very healthy. You may be able to lock in a lower premium with a private policy than the group rate offered at work.

- You need a very large amount of coverage. If you need $1 million or more in coverage, you will likely need to purchase a policy on the private market to reach that amount.

Conclusion

So, is voluntary life insurance worth it? For most people, the answer is a resounding yes.

It is an excellent, affordable, and incredibly convenient way to increase your family’s financial protection beyond the basic coverage your employer provides. The ability to get a significant amount of coverage without a medical exam makes it a fantastic opportunity for many employees.

However, because it is not portable, it’s wise to think of it as a crucial part of your financial plan, but not the entire plan. For true long-term peace of mind, you may also want to consider a private term life policy that will stay with you no matter where your career takes you. During this open enrollment, take a close look at your options—it’s a great chance to give your family the protection they deserve.